Featured Articles June 2020

Posted on Jun 1st 2020

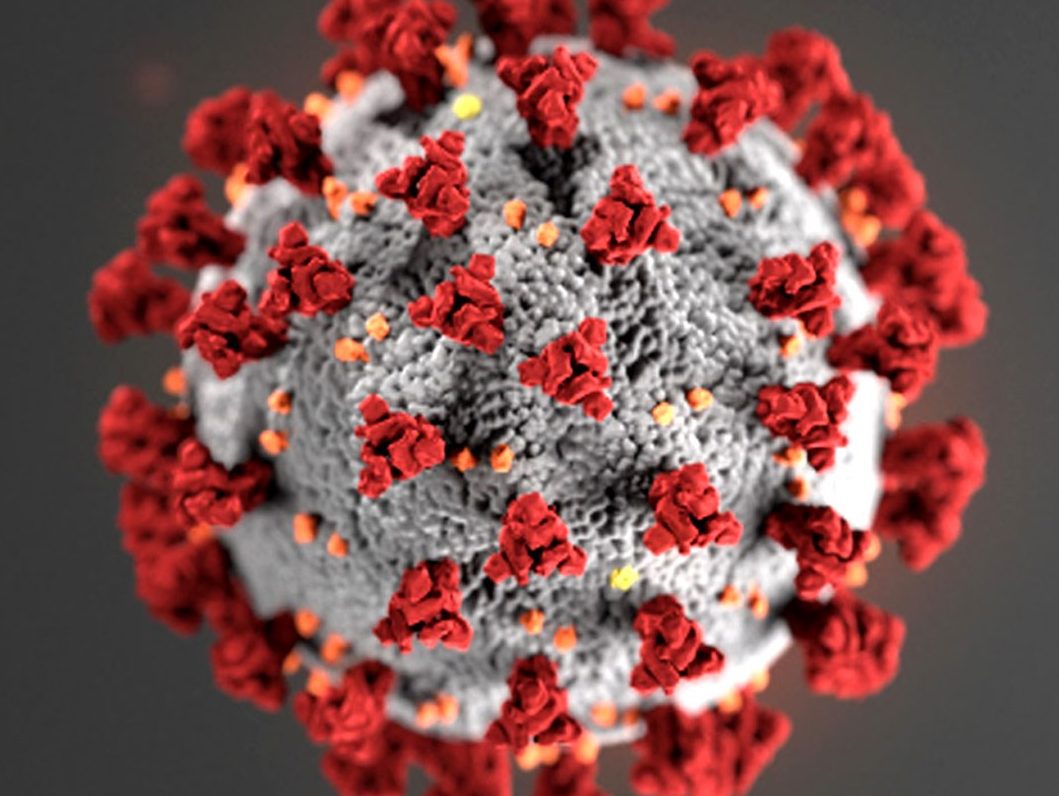

As part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, signed into law March 27, many small business owners were able to apply for - and receive - a loan of up to $10 million under the Paycheck Protection Program (PPP). Businesses - including nonprofits, veterans' organizations, Tribal entities, self-employed individuals, sole proprietorships, and independent contractors - that were in operation on February 15 and that have 500 or fewer employees are eligible for the PPP loans. The deadline for applying for a PPP loan is June 30, 2020. If the loan proceeds are used as specified, business owners may apply to have the loan forgiven.

Featured Articles May 2020

Posted on May 1st 2020

As a reminder, taxpayers now have until July 15, 2020, to file and pay federal income taxes originally due on April 15 and no late-filing penalty, late-payment penalty or interest will be due. Due to the coronavirus pandemic, this relief has been expanded to include additional returns, tax payments and other actions

Featured Articles April 2020

Posted on Apr 1st 2020

Due to the coronavirus pandemic, the federal income tax filing due date is automatically extended from April 15, 2020, to July 15, 2020. Taxpayers can also defer federal income tax payments due on April 15, 2020, to July 15, 2020, without penalties and interest, regardless of the amount owed. In addition, the payment and return-filing requirements for gift and generation-skipping transfer taxes due April 15 are now due July 15, matching postponements granted to federal income taxes and returns.

COVID-19 Update: Taxes

Posted on Mar 16th 2020

In view of the pandemic that is gripping the world, Paramount is adjusting in ways that will still allow our clients to take care of their tax preparation needs in your area.

Featured Articles January 2020

Posted on Jan 1st 2020

Every year, it's a sure bet that there will be changes to current tax law and this year is no different. From standard deductions to health savings accounts and tax rate schedules, here's a checklist of tax changes to help you plan the year ahead.