Featured Articles April 2018

Feature Articles

- Five Tax Provisions Retroactively Extended for 2017

- Understanding Estimated Tax Payments

- Need to File an Extension? Don't Wait.

- IRS Dirty Dozen Tax Scams for 2018

- Refundable vs. Non-Refundable Tax Credits

Tax Tips

- Late Filing and Late Payment Penalties

- Canceled Debt may be Taxable

- Five Tax Tips for Older Americans

- Time for a Paycheck Checkup

- Correct Filing Status and Reporting Name Changes

QuickBooks Tips

Five Tax Provisions Retroactively Extended for 2017

The Bipartisan Budget Act of 2018 (BBA) retroactively extended a number of tax provisions through 2017 for individual taxpayers. Let's take a look at five of them, brought to you by our accounting firms.

1. Mortgage Insurance PremiumsHomeowners with less than 20 percent equity in their homes are required to pay mortgage insurance premiums (PMI). For taxpayers whose income is below certain threshold amounts, these premiums were deductible in tax years 2013, 2014, 2015, 2016 and now, once again in 2017. Mortgage insurance premiums are reported on Schedule A (1040), Itemized Deductions, under "Interest You Paid."

2. Exclusion of Discharge of Principal Residence IndebtednessTypically, forgiven debt is considered taxable income in the eyes of the IRS; however, this tax provision was retroactively extended through 2017. Homeowners whose homes have been foreclosed on or subjected to short sale are able to exclude from gross income up to $2 million of canceled mortgage debt.

3. Energy Saving Home ImprovementsIf you made your home more energy efficient in 2017, you have another chance to take advantage of this tax credit on your tax return. This credit reduces the amount of tax owed as opposed to a deduction that reduces your taxable income. The credit is worth up to 10 percent of the cost (excluding installation) of qualified improvements to a taxpayer's main home to make it more energy efficient such as insulation materials, energy-efficient exterior windows and doors, and certain types of roofs, e.g., metal roof or asphalt roofs specifically designed to reduce the heat gain of your home.

Note: This tax credit is cumulative and has been around for more than 10 years. As such, if you've taken the credit in any tax year since 2006, you will not be able to take the full $500 tax credit this year. For example, if you took a credit of $150 in 2016, the maximum credit you could take this year (2017) is $350.Furthermore, taxpayers should also note that they can only use $200 of this limit for windows.

4. Qualified Tuition and ExpensesThe deduction for qualified tuition and fees was also extended through 2017 and is an above-the-line tax deduction. In other words, you don't have to itemize your deductions to claim the expense. Qualified education expenses are defined as tuition and related expenses required for enrollment or attendance at an eligible educational institution. Related expenses include student-activity fees and expenses for books, supplies, and equipment as required by the institution.

Taxpayers with income of up to $130,000 (joint) or $65,000 (single) can claim a deduction for up to $4,000 in expenses. Taxpayers with income over $130,000 but under $160,000 (joint) and over $65,000 but under $80,000 (single) are able to take a deduction of up to $2,000. Taxpayers with incomes above these threshold amounts are not eligible for the deduction.

5. Deductible Expenses for Live Theatrical ProductionsSection 181 refers to special expensing rules for certain film and television productions that allows taxpayers to treat the costs of any qualified film or television production as a deductible expense. This provision also applies to production costs for qualified live theatrical productions with certain restrictions.

Only the owner of a film, television production or a live theatrical production can make a Section 181 election and if you want to take the deduction on your 2017 tax return your first paid performance must have taken place in 2017. Furthermore, Section 181 only applies to live stage productions where the seating capacity for the performance is less than 3,000 seats and the production must be based on a written play (or book in the case of a musical). This tax provision is complicated. Please call if you need clarification.

Don't miss out on the tax breaks you are entitled to.

If you're wondering whether you should be taking advantage of these and other tax credits and deductions, don't hesitate to call the office. If you've already filed your 2017 federal tax return want to claim one or more of these retroactive tax breaks, please call for assistance in filing an amended tax return.

Understanding Estimated Tax Payments

Estimated tax is the method used to pay tax on income that is not subject to withholding. This includes income from self-employment, interest, dividends, and rent, as well as gains from the sale of assets, prizes and awards. You also may have to pay estimated tax if the amount of income tax being withheld from your salary, pension, or other income is not enough.

Filing and Paying Estimated Taxes

Both individuals and business owners may need to file and pay estimated taxes, which are paid quarterly. In 2018, the first estimated tax payment is due on April 17, the same day tax returns are due. If you do not pay enough by the due date of each payment period you may be charged a penalty even if you are due a refund when you file your tax return.

If you are filing as a sole proprietor, partner, S corporation shareholder, and/or a self-employed individual, you generally have to make estimated tax payments if you expect to owe tax of $1,000 or more when you file your return.

If you are filing as a corporation you generally have to make estimated tax payments for your corporation if you expect it to owe tax of $500 or more when you file its return.

If you had a tax liability for the prior year, you may have to pay estimated tax for the current year; however, if you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings.

Note: There are special rules for farmers, fishermen, certain household employers, and certain higher taxpayers. Please call if you need more information about any of these situations.

Who does not have to pay estimated tax:

You do not have to pay estimated tax for the current year if you meet all three of the following conditions:

- You had no tax liability for the prior year

- You were a U.S. citizen or resident for the whole year

- Your prior tax year covered a 12-month period

If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. To do this, file a new Form W-4 with your employer. There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold.

You had no tax liability for the prior year if your total tax was zero or you did not have to file an income tax return.

Calculating Estimated Taxes

To figure out your estimated tax, you must calculate your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year. If you estimated your earnings too high, simply complete another Form 1040-ES, Estimated Tax for Individuals, worksheet to re-figure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter.

Try to estimate your income as accurately as you can to avoid penalties due to underpayment. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90 percent of the tax for the current year, or 100 percent of the tax shown on the return for the prior year, whichever is smaller.

Tip: When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Use your prior year's federal tax return as a guide and use the worksheet in Form 1040-ES to figure your estimated tax. However, you must make adjustments both for changes in your own situation and for recent changes in the tax law.

Estimated Tax Due Dates

For estimated tax purposes, the year is divided into four payment periods and each period has a specific payment due date. For the 2018 tax year, these dates are April 17, June 15, September 17, and January 15, 2019. You do not have to pay estimated taxes in January if you file your 2018 tax return by January 31, 2019, and pay the entire balance due with your return.

Note: If you do not pay enough tax by the due date of each of the payment periods, you may be charged a penalty even if you are due a refund when you file your income tax return.

The easiest way for individuals as well as businesses to pay their estimated federal taxes is to use the Electronic Federal Tax Payment System (EFTPS). Make ALL of your federal tax payments including federal tax deposits (FTDs), installment agreement and estimated tax payments using EFTPS. If it is easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as you have paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Please call if you are not sure whether you need to make an estimated tax payment or need assistance setting up EFTPS.

Need to File an Extension? Don't Wait.

If you've been procrastinating when it comes to preparing and filing your tax return this year you might be considering filing an extension. While obtaining a 6-month extension to file is relatively easy--and there are legitimate reasons for doing so--there are also some downsides. If you need more time to file your tax return this year, here's what you need to know about filing an extension.

What is an Extension?

An extension of time to file is a formal way to request additional time from the IRS to file your tax return, which in 2018, is due on April 17. Anyone can request an extension, and you don't have to explain why you are asking for more time. It simply requires answering a few questions on Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Part I of the form asks personal information such as name, address and Social Security number. Part II is tax related and asks about estimated tax liability, payments and residency.

Note: Special rules may apply if you are serving in a combat zone or a qualified hazardous duty area or living outside the United States. Please call the office if you need more information.

Individuals are automatically granted an additional six months to file their tax returns. In 2018, the extended due date is October 15. Businesses can also request an extension. In 2018, the deadline for most businesses (whose tax returns were due March 15) is September 17th (October 15 for C-corporations).

Caution: Taxpayers should be aware that an extension of time to file your return does not grant you any extension of time to pay your taxes. In 2018, April 17 is the deadline for most to pay taxes owed and avoid penalty and interest charges.

What are the Pros and Cons of Filing an Extension?

As with most things, there are pros and cons to filing an extension. Let's take a look at the pros of getting an extension to file first.

Pros

1. You can avoid a late-filing penalty if you file an extension. The late-filing penalty is equal to 5 percent per month on any tax due plus a late-payment penalty of half a percent per month. Furthermore, by filing an extension a taxpayer can avoid paying the late-filing penalty, which can be 10 times as costly as the penalty for not paying.

Tip: If you are owed a refund and file late, there is no penalty for late filing.

2. You can also avoid the failure-to-file penalty if you file an extension. If you file your return more than 60 days after the due date (or extended due date), the minimum penalty is the smaller of $135 or 100 percent of the unpaid tax. You will not have to pay a late-filing or late-payment penalty if you can show reasonable cause for not filing or paying on time.

3. You are able to file a more accurate--and complete--tax return. Rather than rushing to prepare your return (and possibly making mistakes), you will have an extra 6 months to gather required tax records. This is helpful if you are still waiting for tax documents that haven't arrived or need more time to organize your tax documents in support of any deductions you might be eligible for.

4. If your tax return is complicated (for example, if you need to recharacterize your Roth IRA conversion or depreciate equipment), then your accountant will have more time available to work on your return.

5. If you are self-employed, you'll have extra time to fund a retirement plan. Individual 401(k) and SIMPLE plans must have been set up during the tax year for which you are filing, but it's possible to fund the plan as late as the extended due date for your prior year tax return. SEP IRA plans may be opened and funded for the previous year by the extended tax return due date as long as an extension has been filed.

6. You are still able to receive a tax refund when you file past the extension due date. Filers have three years from the date of the original due date (April 17, 2018) to claim a tax refund. However, if you file an extension you'll have an additional six months to claim your refund. In other words, the statute of limitations for refunds is also extended.

Cons

And now for the cons of filing an extension...

1. If you are expecting a refund, you'll have to wait longer than you would if you filed on time.

2. Extra time to file is not extra time to pay. If you don't pay a least 90 percent of the tax due now, you will be liable for late-payment penalties and interest. The failure-to-pay penalty is one-half of one percent for each month, or part of a month, up to a maximum of 25 percent of the amount of tax that remains unpaid from the due date of the return until the tax is paid in full. If you are not able to pay, the IRS has a number of options for payment arrangements. Please call the office for details.

3. When you request an extension, you will need to estimate your tax due for the year based on information available at the time you file the extension. If you disregard this, your extension could be denied, and if you filed the extension at the last minute assuming it would be approved (but wasn't), you might owe late-filing penalties as well.

4. Dealing with your tax return won't be any easier 6 months from now. You will still need to gather your receipts, bank records, retirement statements and other tax documents--and file a return.

Need to File an Extension? Don't Wait.

Time is running out. If you feel that you need more time to prepare your federal tax return, then filing an extension of time to file might be the best decision. If you have any questions or are wondering if you need an extension of time to file your tax return, don't hesitate to call.

IRS Dirty Dozen Tax Scams for 2018

Compiled annually by the IRS, the "Dirty Dozen" is a list of common scams taxpayers may encounter. While many of these scams peak during the tax filing season, they may be encountered at any time during the year. Here is this year's list:

1. Phishing

Scam artists continue to victimize taxpayers during filing season using a steady onslaught of new and evolving phishing schemes. Email phishing schemes target payroll professionals, human resources personnel, schools as well as individual taxpayers and even tax professionals, deploying various types of phishing emails in an attempt to access client data. Thieves may use this data to impersonate taxpayers and file fraudulent tax returns for refunds.

In the most recent scam, thousands of taxpayers have been victimized by an unusual scheme that involves their own bank accounts. After stealing client data from tax professionals and filing fraudulent tax returns, the criminals use taxpayers' real bank accounts to direct deposit refunds. Thieves are then using various tactics to reclaim the refund from the taxpayers, including falsely claiming to be from a collection agency or representing the IRS.

Fake emails and websites also can infect a taxpayer's computer with malware without the user knowing it. The malware gives the criminal access to the device, enabling them to access all sensitive files or even track keyboard strokes, exposing login information.

2. Phone Scams

Aggressive and threatening phone calls by criminals impersonating IRS agents remain a major threat to taxpayers. Many phone scams use threats to intimidate and bully a victim into paying. They may even threaten to arrest, deport or revoke the license of their victim if they don't get the money. Since October 2013, the Treasury Inspector General for Tax Administration (TIGTA) reports they have become aware of over 12,716 victims who have collectively paid over $63 million as a result of phone scams.

Con artists claiming to be IRS officials call unsuspecting taxpayers and demand they pay a bogus tax bill. Scammers often alter caller ID numbers to make it look like the IRS or another agency is calling. The callers use IRS titles and fake badge numbers to appear legitimate. They may use the victim's name, address and other personal information to make the call sound official. They convince the victim to send cash, usually through a wire transfer or a prepaid debit card or gift card. They may also leave "urgent" callback requests through phone "robocalls," or send a phishing email (see above for more information about phishing).

3. Identity Theft

Tax-related identity theft occurs when someone uses your stolen Social Security number to file a tax return claiming a fraudulent refund. While the IRS has made significant progress in deterring tax-related identity theft (from 2016 to 2017 identity theft decreased by 40 percent), criminals continue to devise creative ways to steal even more in-depth personal information to impersonate taxpayers. As such, taxpayers and tax professionals must remain vigilant to the various scams and schemes used for data thefts. Business filers should also be aware that cybercriminals file fraudulent Forms 1120 using stolen business identities as well.

Always use security software with firewall and anti-virus protection and make sure security software is always turned on and set to automatically update. Encrypt sensitive files such as tax records stored on the computer. Use strong passwords. Do not click on links or download attachments from unknown or suspicious emails. Protect personal data. Treat personal information like cash; don't leave it lying around. Don't routinely carry a Social Security card, and make sure tax records are secure.

4. Tax Return Preparer Fraud

About 60 percent of taxpayers use tax professionals to prepare their returns. The vast majority of tax professionals provide honest, high-quality service, but there are some dishonest tax preparers who set up shop each filing season. Well-intentioned taxpayers can be misled by tax preparers who don't understand taxes or who mislead people into taking credits or deductions they aren't entitled to in order to increase their fee. Avoid tax preparers who base fees on a percentage of their client's refund or boast bigger refunds than their competition.

Illegal scams can lead to significant penalties and interest and possible criminal prosecution. IRS Criminal Investigation works closely with the Department of Justice (DOJ) to shutdown scams and prosecute the criminals behind them.

5. Fake Charities

Taxpayers should be aware that phony charities use names or websites that sound or look like those of respected, legitimate organizations. For instance, following major disasters, it's common for scam artists to impersonate charities to get money or private information from well-intentioned taxpayers. Scam artists use a variety of tactics including contacting people by telephone or email to solicit money or financial information. They may even directly contact disaster victims and claim to be working for or on behalf of the IRS to help the victims file casualty loss claims and get tax refunds. They may also attempt to get personal financial information or Social Security numbers that can be used to steal the victims' identities or financial resources.

6. Inflated Refund Claims

Taxpayers should be on the lookout for unscrupulous tax return preparers pushing inflated tax refund claims. Scam artists routinely pose as tax preparers during tax time, luring victims in by promising large federal tax refunds or refunds that people never dreamed they were due in the first place. They might, for example, promise inflated refunds based on fictitious Social Security benefits and false claims for education credits, the Earned Income Tax Credit (EITC), the Additional Child Tax Credit (ACTC) or the American Opportunity Tax Credit (AOTC), among others. They may also file a false return in their client's name, and the client never knows that a refund was paid.

Filing a phony information return, such as a Form 1099 or W-2, is an illegal way to lower the amount of taxes owed. The use of self-prepared, "corrected" or otherwise bogus forms that improperly report taxable income as zero is illegal. So is an attempt to submit a statement rebutting wages and taxes reported by a third-party payer to the IRS. In some cases, individuals have made refund claims based on the bogus theory that the federal government maintains secret accounts for U.S. citizens and that taxpayers can gain access to the accounts by issuing 1099-OID forms to the IRS.

Because taxpayers are legally responsible for what is on their returns (even if it was prepared by someone else), those who buy into such schemes can end up being penalized for filing false claims or receiving fraudulent refunds.

7. Excessive Claims for Business Credits

Improper claims for business credits such as the fuel tax credit and the research credit are also on the IRS "Dirty Dozen" list this year. The fuel tax credit is generally limited to off-highway business use or use in farming. Consequently, the credit is not available to most taxpayers. Still, the IRS routinely finds unscrupulous tax preparers who have enticed sizable groups of taxpayers to erroneously claim the credit to inflate their refunds.

Fraud involving the fuel tax credit is considered a frivolous tax claim and can result in a penalty of $5,000. Improper claims for the fuel tax credit generally come in two forms. An individual or business may make an erroneous claim on their otherwise legitimate tax return. It is also possible for an identity thief to claim the credit as part of a broader fraudulent scheme.

Improper claims for the research credit generally involve a failure to participate in or substantiate qualified research activities and/or a failure to satisfy the requirements related to qualified research expenses. In addition, qualified research expenses include only in-house wages and supply expenses and 65 percent (typically) of payments to contractors. Qualified research expenses do not include expenses without a proven nexus between the claimed expenses and the qualified research activity.

To qualify for the credit, a taxpayer's research activities must, among other things, involve a process of experimentation using science with a goal of improving a product or process the taxpayer uses in its business or holds for sale or lease. Certain activities specifically excluded from the credit including research after commercial production, adaptation of an existing business product or process, foreign research and research funded by the customer. Qualified activities also do not include activities where there is no uncertainty about the taxpayer's method or capability to achieve a desired result.

8. Falsely Padding Deductions on Tax Returns

The vast majority of taxpayers file honest and accurate tax returns on time every year. However, each year some taxpayers fail to resist the temptation of fudging their information. That's why falsely claiming deductions, expenses or credits on tax returns is on the "Dirty Dozen" tax scams list for the 2018 filing season. The IRS warns taxpayers that they should think twice before overstating deductions such as charitable contributions, padding their claimed business expenses or including credits that they are not entitled to receive.

Avoid the temptation of falsely inflating deductions or expenses on your return to underpay what you owe and possibly receive larger refunds. Taxpayers may be subject to criminal prosecution and be brought to trial for actions such as willful failure to file a return, supply information, or pay any tax due; fraud and false statements, preparing and filing a fraudulent return and identity theft.

9. Falsifying Income to Claim Credits

This scam involves inflating or including income on a tax return that was never earned, either as wages or as self-employment income, usually in order to maximize refundable credits. Falsely claiming an expense or deduction you did not pay, claiming income you did not earn could have serious repercussions. Con artists often argue that the proper way to redeem or draw on a fictitious "held-aside" account is to use some form of made-up financial instrument, such as a bonded promissory note, that purports to be a debt payment method for credit cards or mortgage debt. Scammers provide fraudulent Form(s) 1099-MISC that appear to be issued by a large bank, loan service and/or mortgage company with which the taxpayer may have had a prior relationship.

Well-intentioned individual taxpayers who don't understand taxes or unscrupulous return preparers who mislead people into taking credits or deductions they aren't entitled to do this to secure larger refundable credits (e.g., the Earned Income Tax Credit) to charge a higher fee; however, it can have serious repercussions. Taxpayers can face a large bill to repay the erroneous refunds, including interest and penalties. In some cases, they may even face criminal prosecution.

Remember: Taxpayers are legally responsible for what's on their tax return whether it is prepared using tax software or a tax professional.

10. Frivolous Tax Arguments

Taxpayers are also warned against using frivolous tax arguments to avoid paying their taxes. Examples include contentions that taxpayers can refuse to pay taxes on religious or moral grounds by invoking the First Amendment or that the only "employees" subject to federal income tax are employees of the federal government, and that only foreign-source income is taxable.

Promoters of frivolous schemes encourage taxpayers to make unreasonable and outlandish claims to avoid paying the taxes they owe. These arguments are wrong and have been thrown out of court. While taxpayers have the right to contest their tax liabilities in court, no one has the right to disobey the law or disregard their responsibility to pay taxes. The penalty for filing a frivolous tax return is $5,000.

11. Abusive Tax Shelters

Abusive tax shelters, particularly those involving micro-captive insurance shelters, are on the list again for 2018. Phony tax shelters and structures to avoid paying taxes continues to be a problem and taxpayers should steer clear of these types of schemes as they can end up costing taxpayers more in back taxes, penalties, and interest than they saved in the first place.

Another tax shelter abuse involving a legitimate tax structure involves certain small or "micro" captive insurance companies. In the abusive structure, unscrupulous promoters, accountants, or wealth planners persuade the owners of closely held entities to participate in these schemes. The promoters assist the owners to create captive insurance companies onshore or offshore and cause the creation and sale of the captive "insurance" policies to the closely held entities. The promoters manage the entities' captive insurance companies for substantial fees, assisting taxpayers unsophisticated in insurance, to continue the charade from year to year.

For example, coverages may insure implausible risks, fail to match genuine business needs or duplicate the taxpayer's commercial coverages. Premium amounts may be unsupported by underwriting or actuarial analysis may be geared to a desired deduction amount or may be significantly higher than premiums for comparable commercial coverage. Policies may contain vague, ambiguous or deceptive terms and otherwise, fail to meet industry or regulatory standards. Claims' administrative processes may be insufficient or altogether absent. Insureds may fail to file claims that are seemingly covered by the captive insurance.

Micro-captives may invest in illiquid or speculative assets or loans or otherwise transfer capital to or for the benefit of the insured, the captive's owners or other related persons or entities. Captives may also be formed to advance intergenerational wealth transfer objectives and avoid estate and gift taxes. Promoters, reinsurers and captive insurance managers may share common ownership interests that result in conflicts of interest.

The bottom line: Don't use abusive tax structures to avoid paying taxes. The IRS is committed to stopping complex tax avoidance schemes and the people who create and sell them. The vast majority of taxpayers pay their fair share, and everyone should be on the lookout for people peddling tax shelters that sound too good to be true. When in doubt, seek an independent opinion if offered complex products.

12. Unreported Offshore Accounts

Through the years, offshore accounts have been used to lure taxpayers into scams and schemes. Numerous individuals have been identified as evading U.S. taxes by hiding income in offshore banks, brokerage accounts or nominee entities and then using debit cards, credit cards or wire transfers to access the funds. Others have employed foreign trusts, employee-leasing schemes, private annuities or insurance plans for the same purpose.

While there are legitimate reasons for maintaining financial accounts abroad, there are reporting requirements that need to be fulfilled. U.S. taxpayers who maintain such accounts and who do not comply with reporting requirements are breaking the law and risk significant penalties and fines, as well as the possibility of criminal prosecution.

Since 2009, tens of thousands of individuals have come forward to voluntarily disclose their foreign financial accounts through the Offshore Voluntary Disclosure Program (OVDP), taking advantage of special opportunities to comply with the U.S. tax system and resolve their tax obligations. The IRS recently announced that this voluntary program will end on September 28, 2018.

If you think you've been a victim of a tax scam, please contact the office immediately.

Refundable vs. Non-Refundable Tax Credits

Tax credits can reduce your tax bill or give you a bigger refund but not all tax credits are created equal. While most tax credits are refundable, some credits are nonrefundable but before we take a look at the difference between refundable and nonrefundable tax credits, it's important to understand the difference between a tax credit and a tax deduction.

Understanding the Difference between a Tax Credit and a Tax Deduction

Tax credits reduce your tax liability dollar for dollar and are more valuable than tax deductions that reduce your taxable income and tied to your marginal tax bracket. Let's look at the difference between a tax credit of $1,000 and a tax deduction of $1,000 for a taxpayer whose income places them in the 22% tax bracket:

- A tax credit worth $1,000 reduces the amount of tax owed by $1,000--the same dollar amount.

- A tax deduction worth the same amount ($1,000) only saves you $330, however (0.22 x $1,000 = $220). As you can see, tax credits save you more money than tax deductions.

Tax Credits: Refundable vs. Nonrefundable

A refundable tax credit not only reduces the federal tax you owe but also could result in a refund if it more than you owe. Let's say you are eligible to take a $1,000 Child Tax Credit but only owe $200 in taxes. The additional amount ($800) is treated as a refund to which you are entitled.

A nonrefundable tax credit, on the other hand, means you get a refund only up to the amount you owe. For example, if you are eligible to take an American Opportunity Tax Credit worth $1,000 and the amount of tax owed is only $800, you can only reduce your taxable amount by $800--not the full $1,000.

Refundable Tax Credits

- The Earned Income Tax Credit

- The Child and Dependent Care Credit

- The Saver's Credit

Nonrefundable Tax Credits

Examples of nonrefundable tax credits include:

- Adoption Tax Credit

- Foreign Tax Credit

- Mortgage Interest Tax Credit

- Residential Energy Property Credit

- Credit for the Elderly or the Disabled

- Child Tax Credit (tax years prior to 2018)

Partially Refundable Tax Credits

Some tax credits are only partially refundable such as:

- Child Tax Credit (starting in 2018)

- American Opportunity Tax Credit

Questions about tax credits or deductions?

If you have any questions or would like more information about either of these tax topics, please call.

Late Filing and Late Payment Penalties

April 17 is the deadline for most people to file their federal income tax return and pay any taxes they owe. The bad news is that if you miss the deadline (for whatever reason) you may be assessed penalties for both failing to file a tax return and for failing to pay taxes they owe by the deadline. The good news is that there is no penalty if you file a late tax return but are due a refund.

Here are ten important facts every taxpayer should know about penalties for filing or paying late:

1. A failure-to-file penalty may apply. If you owe tax, and you failed to file and pay on time, you will most likely owe interest and penalties on the tax you pay late.

2. Penalty for filing late. The penalty for filing a late return is normally 5 percent of the unpaid taxes for each month or part of a month that a tax return is late and starts accruing the day after the tax filing due date. Late filing penalties will not exceed 25 percent of your unpaid taxes.

3. Failure to pay penalty. If you do not pay your taxes by the tax deadline, you normally will face a failure-to-pay penalty of 1/2 of 1 percent of your unpaid taxes. That penalty applies for each month or part of a month after the due date and starts accruing the day after the tax-filing due date.

4. The failure-to-file penalty is generally more than the failure-to-pay penalty. You should file your tax return on time each year, even if you're not able to pay all the taxes you owe by the due date. You can reduce additional interest and penalties by paying as much as you can with your tax return. You should explore other payment options such as getting a loan or making an installment agreement to make payments. Contact the office today if you need help figuring out how to pay what you owe.

5. Extension of time to file. If you timely requested an extension of time to file your individual income tax return and paid at least 90 percent of the taxes you owe with your request, you may not face a failure-to-pay penalty. However, you must pay any remaining balance by the extended due date.

6. Two penalties may apply. One penalty is for filing late and one is for paying late--and they can add up fast, especially since interest accrues on top of the penalties but if both the 5 percent failure-to-file penalty and the 1/2 percent failure-to-pay penalties apply in any month, the maximum penalty that you'll pay for both is 5 percent.

7. Minimum penalty. If you file your return more than 60 days after the due date or extended due date, the minimum penalty is the smaller of $135 or 100 percent of the unpaid tax.

8. Reasonable cause. You will not have to pay a late-filing or late-payment penalty if you can show reasonable cause for not filing or paying on time. Please call if you have any questions about what constitutes reasonable cause.

9. Penalty relief. The IRS generally provides penalty relief, including postponing filing and payment deadlines, to any area covered by a disaster declaration for individual assistance issued by the Federal Emergency Management Agency (FEMA). For example, taxpayers who were victims of Hurricane Maria in certain municipalities of Puerto Rico and the Virgin Islands have until June 29, 2018, to file and pay.

10. File even if you can't pay. Filing on time and paying as much as you can, keeps your interest and penalties to a minimum. If you can't pay in full, getting a loan or paying by debit or credit card may be less expensive than owing the IRS. If you do owe the IRS, the sooner you pay your bill the less you will owe.

If you need assistance, help is just a phone call away!

Canceled Debt may be Taxable

If a lender cancels part or all of a debt, a taxpayer must generally consider this as income. However, the law allows an exclusion that may apply to homeowners who had their mortgage debt canceled in 2017. Here are seven things you should know about debt cancellation:

1. Main Home. If the canceled debt was a loan on a taxpayer's main home, they may be able to exclude the canceled amount from their income. They must have used the loan to buy, build or substantially improve their main home to qualify. Their main home must also secure the mortgage.

2. Loan Modification. If a taxpayer's lender canceled or reduced part of their mortgage balance through a loan modification or "workout," the taxpayer may be able to exclude that amount from their income. They may also be able to exclude debt discharged as part of the Home Affordable Modification Program (HAMP). The exclusion may also apply to the amount of debt canceled in a foreclosure.

3. Refinanced Mortgage. The exclusion may apply to amounts canceled on a refinanced mortgage. This applies only if the taxpayer used proceeds from the refinancing to buy, build or substantially improve their main home and only up to the amount of the old mortgage principal just before refinancing. Amounts used for other purposes do not qualify.

4. Other Cancelled Debt. Other types of canceled debt such as second homes, rental and business property, credit card debt or car loans do not qualify for this special exclusion. On the other hand, there are other rules that may allow those types of canceled debts to be nontaxable.

5. Form 1099-C. If a lender reduced or canceled at least $600 of a taxpayer's debt, the taxpayer should have received Form 1099-C, Cancellation of Debt, by January 31, 2018. This form shows the amount of canceled debt and other information.

6. Form 982. If a taxpayer qualifies, report the excluded debt on Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness. They should file the form with their income tax return.

7. Exclusion Extended. The law that authorized the exclusion of cancelled debt from income was extended through December 31, 2017.

Don't hesitate to contact the office if you have any questions about canceled debt.

Five Tax Tips for Older Americans

Everyone wants to save money on their taxes, and older Americans are no exception. If you're age 50 or older, here are five tax tips that could help you do just that.

1. Standard Deduction for Seniors. If you and/or your spouse are 65 years old or older and you do not itemize your deductions, you can take advantage of a higher standard deduction amount. There is an additional increase in the standard deduction if either you or your spouse is blind.

2. Credit for the Elderly or Disabled. If you and/or your spouse are either 65 years or older--or under age 65 years old and are permanently and totally disabled--you may be able to take the Credit for Elderly or Disabled. If you are under age 65, you must have your physician complete a statement certifying that you had a permanent and total disability on the date you retired. You must also have taxable disability income that meets certain requirements.

The Credit is based on your age, filing status, and income and you must file using Form 1040 or Form 1040A to receive the Credit for the Elderly or Disabled. You cannot get the Credit for the Elderly or Disabled if you file using Form 1040EZ.

You may only take the credit if you meet the following:

In 2017 your income on Form 1040 line 38 must be less than $17,500 ($20,000 if married filing jointly and only one spouse qualifies), $25,000 (married filing jointly and both qualify), or $12,500 (married filing separately and lived apart from your spouse for the entire year).

and

The non-taxable part of your Social Security or other nontaxable pensions, annuities or disability income is less than $5,000 (single, head of household, or qualifying widow/er with dependent child); $5,000 (married filing jointly and only one spouse qualifies); $7,500 (married filing jointly and both qualify); or $3,750 (married filing separately and lived apart from your spouse the entire year).

3. Retirement Account Limits Increase. Once you reach age 50, you are eligible to contribute (and defer paying tax on) up to $24,500 in 2018 (up $500 from 2017). The amount includes the additional $6,000 "catch up" contribution for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the federal government's Thrift Savings Plan.

4. Early Withdrawal Penalty Eliminated. If you withdraw money from an IRA account before age 59 1/2 you generally must pay a 10 percent penalty (there are exceptions--call for details); however, once you reach age 59 1/2, there is no longer a penalty for early withdrawal. Furthermore, if you leave or are terminated from your job at age 55 or older (age 50 for public safety employees), you may withdraw money from a 401(k) without penalty--but you still have to pay tax on the additional income. To complicate matters, money withdrawn from an IRA is not exempt from the penalty.

5. Higher Income Tax Filing Threshold. Taxpayers who are 65 and older are allowed an income of $1,550 more ($2,500 married filing jointly) in 2017 before they need to file an income tax return. In other words, older taxpayers age 65 and older with income of $11,950 ($23,300 married filing jointly)in 2017 or less may not need to file a tax return.

Don't hesitate to call if you have any questions about these and other tax deductions and credits available for older Americans.

Time for a Paycheck Checkup

Withholding issues can be complicated, and with the passage of the recent tax reform legislation--most of which takes effect starting in 2018--, it's important to make sure the right amount of tax is withheld for your personal tax situation. As a first step to reflect the tax law changes, the IRS released new withholding tables in January 2018. A revised Form W-4 was released on February 28, 2018. These updated tables were designed to produce the correct amount of tax withholding.

For taxpayers with simple tax situations, the easiest way to do check whether their withholding is correct is to use the IRS Withholding Calculator on IRS.gov, which is designed to help employees make changes based on their individual financial situation.

Using the Withholding Calculator to perform a quick "paycheck checkup" protects employees from having too little tax withheld and facing an unexpected tax bill or penalty at tax time in 2019. It can also prevent employees from having too much tax withheld. With the average refund topping $2,800, some taxpayers, of course, might prefer to have less tax withheld up front and receive more in their paychecks.

Taxpayers should keep in mind, however, that the IRS Withholding Calculator results are only as accurate as the information entered. If your circumstances change during the year, come back to the calculator to make sure your withholding is still correct.

With the new tax law changes, people with more complex tax situations such as married couples who both work, higher income earners, and who take certain tax credits or itemize might need to revise their Form W-4 completely to ensure they have the right amount of withholding taken out of their pay.

Small business owners or sole proprietors who owe self-employment tax, or individual taxpayers who need to pay the alternative minimum tax, or owe tax on unearned income from dependents, as well as people who have capital gains and dividends should contact the office and speak to a tax professional.

Using the Withholding Calculator

The Withholding Calculator asks taxpayers to estimate their 2018 income and other items that affect their taxes, including the number of children claimed for the Child Tax Credit, Earned Income Tax Credit and other items. It does not request personally-identifiable information such as name, Social Security number, address or bank account numbers, nor does the IRS save or record the information entered on the calculator. Here are the steps you need to take:

- Gather your most recent pay stub from work. Check to make sure it reflects the amount of Federal income tax that you have had withheld so far in 2018.

- Have a completed copy of your 2017 tax return handy. Information on your return can help you estimate income and other items for 2018. If you haven't filed your 2017 tax return yet you can use a 2016 tax return; however, please remember that the new tax law made significant changes to itemized deductions.

- Use the results from the Withholding Calculator to determine if you should complete a new Form W-4 and, if so, what information to put on a new Form W-4. There is no need to complete the worksheets that accompany Form W-4 if the calculator is used.

- As a general rule, the fewer withholding allowances you enter on the Form W-4 the higher your tax withholding will be. Entering "0" or "1" on line 5 of the W-4 means more tax will be withheld. Entering a bigger number means less tax withholding, resulting in a smaller tax refund or potentially a tax bill or penalty.

If you complete a new Form W-4, you should submit it to your employer as soon as possible. With withholding occurring throughout the year, it's better to take this step early on. If you have any questions, please call.

Correct Filing Status and Reporting Name Changes

If you haven't filed your taxes yet, it's time to stop procrastinating. If you're not sure what to do first, the fastest way to get started is to figure out which filing status applies to you. In addition, if your name or that of a dependent changed during the tax year for which you are filing, then you will also need to report the name changes to the Social Security Administration.

Choosing the Correct Filing Status

Choosing the correct filing status is important because it can affect the amount of tax you owe for the year. It may even determine if you must file a tax return. Here are the five filing statuses you can choose from:

1. Single. This status normally applies if you aren't married. It applies if you are divorced or legally separated under state law.

2. Married Filing Jointly. If you're married, you and your spouse can file a joint tax return. If your spouse died in 2017, you can often file a joint return for that year.

3. Married Filing Separately. A married couple can choose to file two separate tax returns. This may benefit you if it results in less tax owed than if you file a joint tax return. You may want to prepare your taxes both ways before you choose. You can also use it if you want to be responsible only for your own tax.

4. Head of Household. In most cases, this status applies if you are not married, but there are some special rules. For example, you must have paid more than half the cost of keeping up a home for yourself and a qualifying person. Don't choose this status by mistake. Be sure to check all the rules.

5. Qualifying Widow(er) with Dependent Child. This status may apply to you if your spouse died during 2015 or 2016 and you have a dependent child. Other conditions also apply.

Taxpayers are reminded that your marital status on December 31 determines your status for the whole year. Sometimes, however, more than one filing status may apply to you. If that happens, choose the one that allows you to pay the least amount of tax.

Reporting Name Changes

All of the names on a taxpayer's tax return must match Social Security Administration records and a name mismatch can delay a tax refund. Here's what you should do if anyone listed on their tax return changed their name:

1. Reporting Taxpayer's Name Change. Taxpayers who should notify the SSA of a name change include the following:

- Taxpayers who got married and use their spouse's last name.

- Recently married taxpayers who now use a hyphenated name.

- Divorced taxpayers who now use their former last name.

2. Reporting Dependent's Name Change. Taxpayers should notify the SSA if a dependent's name changed. This includes an adopted child who now has a new last name. If the child doesn't have a Social Security number, the taxpayer may use a temporary Adoption Taxpayer Identification Number (ATIN) on the tax return. Taxpayers can apply for an ATIN by filing a Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions.

3. Getting a New Social Security Card. Taxpayers who have a name change should get a new card that reflects a name change. File Form SS-5, Application for a Social Security Card. Taxpayers can get the form on SSA.gov or by calling 800-772-1213.

If you have any questions about these or any other aspects of filing your tax return, don't hesitate to call the office immediately.

Tracking Time in QuickBooks, Part 2

Last month, we learned about getting QuickBooks ready for time-tracking by activating it in Preferences and creating a record for a service item. This month, the focus is on using that record in the two different ways you will be using it in QuickBooks: to pay employees for their hourly work and to bill customers for services.

Recording Employee Hours

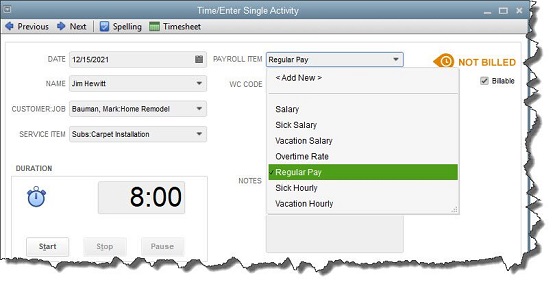

There are two ways to enter hours for your employees who provide services to customers and are paid by the hour. The first is to create a work ticket for a single activity. Click Enter Time on the home page, and then Time/Enter Single Activity to open this window:

Figure 1: Single-activity work tickets for employee hours are especially useful if you need to set a timer.

First, check the date to make sure it displays the day when the work was actually done, not recorded. Click the arrow in the field next to Name and select the employee's name from the drop-down list that opens, then do the same in the Customer: Job field below. The Service Item field needs to display the name of the service performed by the employee.

If you want to time a period of activity, use the Start, Stop, and Pause buttons under Duration. You can also replace the 0:00 that appears by default with the number of hours and minutes that were worked.

In the middle column, select the correct Payroll Item from the drop-down list. You can add a new employee if necessary without completing his or her entire record, but be sure to go back and complete it before your next payroll.

Hidden behind the drop-down menu is a field titled WC Code, which stands for Work.

Do you have any questions? Contact Paramount Tax today, we're happy to help!