Paramount Tax & Accounting in Las Vegas Blog

Got Debt? How to Improve your Financial Situation - Las Vegas

Posted on Jan 10th 2018

If you are having trouble paying your debts, it is important to take action sooner rather than later. Doing nothing leads to much larger problems in the future, whether it's a bad credit record or bankruptcy resulting in the loss of assets and even your home. If you're in financial trouble, then here are some steps to take to avoid financial ruin in the future. Contact Paramount Tax & Accounting in Las Vegas to learn more about our accounting firms in Las Vegas.

Small Business: Be Alert to Identity Theft - Las Vegas

Posted on Jan 10th 2018

Small business identity theft is a big business for identity thieves. Just like individuals, businesses may have their identities stolen, and their sensitive information used to open credit card accounts or used to file fraudulent tax refunds for bogus refunds. As such, small business owners should be on guard against a growing wave of identity theft against employers. Contact Paramount Tax & Accounting in Las Vegas to learn more about our small business accounting services in Las Vegas.

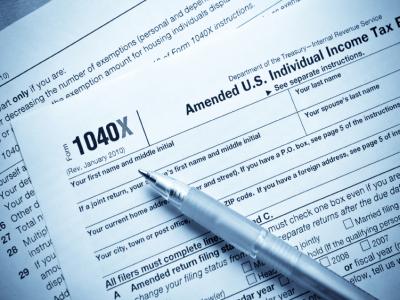

Important Tax Changes for 2018 - Paramount Tax & Accounting in Las Vegas

Posted on Jan 10th 2018

Welcome, 2018! Each new year brings changes to current tax law and 2018 is no different. From tax rate schedules to health savings accounts, here's a checklist of tax changes to help you plan the year ahead, brought to you by Paramount Tax & Accounting in Las Vegas's tax accountants in Las Vegas.

Paramount Tax Now Offering Financial and Tax Franchises Across the US - Paramount Tax & Accounting in Las Vegas

Posted on Nov 10th 2017

For the first time, Paramount Tax is offering franchises. Let us make our success into your success! Contact Paramount Tax & Accounting in Las Vegas's CPA accounting in Las Vegas to learn more.

Featured Articles August 2020 Las Vegas

Posted on Dec 31st 1969

The "Dirty Dozen" is a list of common tax scams that target taxpayers. Compiled and issued annually every year by the IRS, this year it includes many aggressive and evolving schemes related to coronavirus tax relief. The criminals behind these bogus schemes view everyone as potentially easy prey and everyone should be on guard, especially vulnerable populations such as the elderly.