Paramount Tax & Accounting East Hillsborough Blog

Featured Articles July 2018 - Amherst

Five Tax Deductions that Disappeared in 2018

Under tax reform, taxpayers who itemize should be aware that deductions they may have previously counted on to reduce their taxable income have disappeared in 2018. Here are Five Tax Deductions that Disappeared in 2018, brought to you by our accounting firms in Amherst. Contact Paramount of Amherst for more information.

1. Moving Expenses

Prior to tax reform (i.e., for tax years starting before January 1, 2018), taxpayers could deduct expenses related to moving for a job as long as the move met certain IRS criteria. However, for tax years 2018 through 2025, moving expenses are no longer deductible--unless you are a member of the Armed Forces on active duty who moves because of a military order.

2. Unreimbursed Job Expenses

For tax years starting in 2018 and expiring at the end of 2025, miscellaneous unreimbursed job-related expenses that exceed 2% of adjusted gross income (AGI) are no longer deductible on Schedule A (Form 1040). Examples of unreimbursed job-related expenses include union dues, continuing education, employer-required medical tests, regulatory and license fees (provided the employee was not reimbursed), and out-of-pocket expenses paid by an employee for uniforms, tools, and supplies.

3. Tax Preparation Fees

Tax preparation fees, which fall under miscellaneous fees on Schedule A of Form 1040 (also subject to the 2% floor), have been eliminated for tax years 2018 through 2025. Tax preparation fees include payments to accountants, tax prep firms, as well as the cost of tax preparation software.

4. Personal Exemptions

Repealed for tax years 2018 through 2025, the personal exemption enabled individual taxpayers to reduce taxable income ($4,050 in 2017). Each household dependent was able to take the deduction as well. While the standard deduction did increase significantly ($12,000 for individuals, $24,000 for married taxpayers filing jointly, $18,000 for heads of household) to compensate, some taxpayers may still lose out.

5. Subsidized Parking and Transit Reimbursements for Employers

Before tax reform, employees could take advantage of a perk offered by many employers whereby parking and transit pass costs (up to $255 per month in 2017) were reimbursed by their employers tax-free. These reimbursements were not included in the employee's taxable income and were deductible to companies on their tax returns. However, for tax years starting in 2018, the employer deduction is no longer available.

If you have any questions about tax reform and how it affects your particular tax situation, don't hesitate to call.

Tax Benefits of S-Corporations

As a small business owner, figuring out which form of business structure to use when you started was one of the most important decisions you had to make; however, it's always a good idea to periodically revisit that decision as your business grows. For example, as a sole proprietor, you must pay a self-employment tax rate of 15% in addition to your individual tax rate; however, if you were to revise your business structure to become a corporation and elect S-Corporation status you could take advantage of a lower tax rate.

What is an S-Corporation?

An S-Corporation (or S-Corp) is a regular corporation whose owners elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax (and sometimes state) purposes. That is, an S-corporation is a corporation or a limited liability company that's made a Subchapter S election (so named after a chapter of the tax code). Rather than a business entity per se, it is a type of tax classification. Shareholders then report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates, which allows S-corporations to avoid double taxation on corporate income. S-corporations are, however, responsible for tax on certain built-in gains and passive income at the entity level.

To qualify for S-corporation status, the corporation must submit a Form 2553, Election by a Small Business Corporation to the IRS, signed by all the shareholders, and meet the following requirements:

- Be a domestic corporation

- Have only allowable shareholders. Shareholders may be individuals, certain trusts, and estates but may not be partnerships, corporations or non-resident alien shareholders.

- Have no more than 100 shareholders

- Have only one class of stock

- Not be an ineligible corporation (i.e. certain financial institutions, insurance companies, and domestic international sales corporations).

What are the Tax Advantages of an S-Corp?

Personal Income and Employment Tax Savings

S-corporation owners can choose to receive both a salary and dividend payments from the corporation (i.e., distributions from earnings and profits that pass through the corporation to you as an owner, not as an employee in compensation for your services). Dividends are taxed at a lower rate than self-employment income, which lowers taxable income. S-corp owners also save on Social Security and Medicare taxes because their salary is less than it would be if they were operating a sole proprietorship, for instance.

The split between salary and dividends must be "reasonable" in the eyes of the IRS, however, e.g., paying self-employment tax on 50% or less of profits or a salary that is in line with similar businesses. Furthermore, some S-corp owners may be able to take advantage of the 20% deductions for pass-through entities as well, thanks to tax reform.

Losses are Deductible

As a corporation, profits and losses are allocated between the owners based on the percentage of ownership or number of shares held. If the S-corporation loses money, these losses are deductible on the shareholder's individual tax return. For example, if you and another person are the owners and the corporation's losses amount to $20,000, each shareholder is able to take $10,000 as a deduction on their tax return.

No Corporate Income Tax

Although S-corps are corporations, there is no corporate income tax because business income is passed through to the owners instead of being taxed at the corporate rate, thereby avoiding the double taxation issue, which occurs when dividend income is taxed at both the corporate level and at the shareholder level.

Less Risk of Audit

In 2014, S-corps faced an audit risk of just 0.42% compared to Schedule C filers with gross receipts of $100,000 who faced an audit rate of 2.3%. While still low, individuals filing Schedule C (Profit or Loss from Business) are at higher risk of being audited due to IRS concerns about small business owners underreporting income or taking deductions they shouldn't be.

Help is just a phone call away.

Whether you keep your existing structure or decide to change it to a different one, keep in mind that your decision should always be based on the specific needs and practices of the business. If you have any questions about electing S-Corporation status or are wondering whether it's time to choose a different business entity altogether, don't hesitate to call.

Tax Rules for Rental Income from Second Homes

Tax rules on rental income from second homes can be complicated, particularly if you rent the home out for several months of the year and also use the home yourself.

There is, however, one provision that is not complicated. Homeowners who rent out their property for 14 or fewer days a year can pocket the rental income, tax-free. In other words, if you live close to a vacation destination such as the beach or mountains, you may be able to make some extra cash by renting out your home (principal residence) when you go on vacation--as long as it's two weeks or less. Although you can't take depreciation or deduct for maintenance, you can deduct mortgage interest, property taxes, and casualty losses on Schedule A (1040), Itemized Deductions.

In general, however, income from rental of a vacation home for 15 days or longer must be reported on your tax return on Schedule E, Supplemental Income and Loss. Your rental income may also be subject to the net investment income tax. You should also keep in mind that the definition of a "vacation home" is not limited to a house. Apartments, condominiums, mobile homes, and boats are also considered vacation homes in the eyes of the IRS.

Furthermore, the IRS states that a vacation home is considered a residence if personal use exceeds 14 days or more than 10 percent of the total days it is rented to others (if that figure is greater). When you use a vacation home as your residence and also rent it to others, you must divide the expenses between rental use and personal use, and you may not deduct the rental portion of the expenses in excess of the rental income.

Example: Let's say you own a beach house (your "second home") and rent it out during the summer between mid-June and mid-September. You and your family also vacation at the house for one week in October and two weeks in December. The rest of the time the house is unused.The family uses the house for 21 days, and it is rented out to others for 121 days for a total of 142 days of use during the year. In this scenario, 85 percent of expenses such as mortgage interest, property taxes, maintenance, utilities, and depreciation can be written off against the rental income on Schedule E. As for the remaining 15 percent of expenses, only the owner's mortgage interest and property taxes are deductible on Schedule A.

Tax Reform and Vacation Rentals

Under tax reform, the amount of interest a homeowner is able to write off is limited to mortgage loan amounts of $750,000 or less for tax years 2018-2025. If you own a second home as well, the two mortgages combined could exceed the $750,000 cap. In addition, property tax deductions (combined with state income taxes) are capped at $10,000. If you do not rent out your second home, you could be losing out on deductions (taxes and mortgage interest) that lower your taxable income. Therefore, it is prudent to consider renting out your second home as a vacation rental since you would then be able to deduct these expenses, and possibly others such as Homeowners Association fees, maintenance expenses, and utilities. Furthermore, you can still use the home 14 days a year (more if you are staying there for home maintenance-related activities) and deduct these expenses. Even if you use it more than 14 days a year, you are still able to deduct these expenses proportional to the amount of rental use.

Questions?

Tax laws are complicated. If you have any questions about renting out your second home or any other tax matters, please call.

Small Business: Budget vs. Actual Reports

What if there were a tool that helped you create crystal-clear plans, provided you with continual feedback about how well your plan was working, and that told you exactly what's working and what isn't?

Well, there is such a tool; it's called the Budget vs. Actual Report, and it's exactly what you need to be able to consistently make smart business decisions to keep your business on track for success.

Be Clear about your Business Plan

The more clear you are about your business goals, the more likely you are to achieve them. Creating a budget forces you to examine the details of your goals, as well as how even a single business decision affects all other aspects of your company's operations.

Example: Let's say that you want to grow your sales by 10 percent this year.

Does that mean you need to hire another salesperson? When will the business start to see new sales from this person? Do you need to set up an office for them? New phone line? Buy them a computer? Do you need to do more advertising? How much more will you spend? When will you see the return on your advertising expenditure?

Sound Business Decisions help you Reach your Goals

Once you clarify your goals, then you start making business decisions to help you reach your desired outcome. Some of those decisions will be great and give you better than expected results, but others might not.

This is when the Budget vs. Actual Report becomes an effective management tool. When you compare your budgeted sales and expenses to your actual results, you see exactly how far off you might be with regard to your budget, goals, and plans.

Sometimes you need to adjust your plan (budget), and sometimes you need to focus more attention to areas of your business that are not performing as well as you planned. Either way, you are gleaning valuable insights into your business.

It's like steering a ship. You may be off-course much of the time, but having a clear goal and making adjustments (both small and large) helps you reach your destination.

Ready to Turn your Dreams into Reality?

while it may seem like an inconvenience to create a budget and then create a Budget vs. Actual Report every month, it is crucial. And, as with any new skill, it does get easier especially with a trusted tax advisor on your side who can help you set up your report quickly and efficiently, as well as help you navigate any difficulties you may encounter.

Call the office today to set up a consultation to get started. You'll be glad you did.

Avoiding Tax Surprises when Retiring Overseas

Are you approaching retirement age and wondering where you can retire to make your retirement nest egg last longer? Retiring abroad may be the answer. But first, it's important to look at the tax implications because not all retirement country destinations are created equal.

Taxes on Worldwide Income

Leaving the United States does not exempt U.S. citizens from their U.S. tax obligations. While some retirees may not owe any U.S. income tax while living abroad, they must still file a return annually with the IRS. This would be the case even if all of their assets were moved to a foreign country. The bottom line is that you may still be taxed on income regardless of where it is earned.

Unlike most countries, the United States taxes individuals based on citizenship and not residency. As such, every U.S. citizen (and resident alien) must file a tax return reporting worldwide income (including income from foreign trusts and foreign bank and securities accounts) in any given taxable year that exceeds threshold limits for filing.

The filing requirement generally applies even if a taxpayer qualifies for tax benefits, such as the foreign earned income exclusion or the foreign tax credit, that substantially reduce or eliminate U.S. tax liability.

Note: These tax benefits are not automatic and are only available if an eligible taxpayer files a U.S. income tax return.

Any income received or deductible expenses paid in foreign currency must be reported on a U.S. return in U.S. dollars. Likewise, any tax payments must be made in U.S. dollars.

In addition, taxpayers who are retired may have to file tax forms in the foreign country in which they reside. You may, however, be able to take a tax credit or a deduction for income taxes you paid to a foreign country. These benefits can reduce your taxes if both countries tax the same income.

Nonresident aliens who receive income from U.S. sources must determine whether they have a U.S. tax obligation. The filing deadline for nonresident aliens is generally April 15 (e.g., April 15, 2019.

FBAR Reporting

U.S. persons who own a foreign bank account, brokerage account, mutual fund, unit trust or another financial account are required to file a Report of Foreign Bank and Financial Accounts (FBAR) by April 15 if they have:

- Financial interest in, signature authority or other authority over one or more accounts in a foreign country, and

- The aggregate value of all foreign financial accounts exceeds $10,000 at any time during the calendar year.

A foreign country does not include territories and possessions of the United States such as Puerto Rico, Guam, United States Virgin Islands, American Samoa, or the Northern Mariana Islands.

Income from Social Security or Pensions

If Social Security is your only income, then your benefits may not be taxable, and you may not need to file a federal income tax return. If you receive Social Security you should receive a Form SSA-1099, Social Security Benefit Statement, showing the amount of your benefits. Likewise, if you have pension or annuity income, you should receive a Form 1099-R for each distribution plan.

Retirement income is generally not taxed by other countries. As a U.S. citizen retiring abroad who receives Social Security, for instance, you may owe U.S. taxes on that income, but may not be liable for tax in the country where you're spending your retirement years.

However, if you receive income from other sources (either U.S. or country of retirement) as well, from a part-time job or self-employment, for example, you may have to pay U.S. taxes on some of your benefits. You may also be required to report and pay taxes on any income earned in the country where you retired.

Each country is different, so consult a local tax professional or one who specializes in expat tax services.

Foreign Earned Income Exclusion

If you've retired overseas, but take on a full or part-time job or earn income from self-employment, the IRS allows qualifying individuals to exclude all, or part, of their incomes from U.S. income tax by using the Foreign Earned Income Exclusion (FEIE). In 2018, this amount is $103,900. This means that if you qualify, you won't pay tax on up to $103,900 of your wages and other foreign earned income in 2018.

Note: Income earned overseas is exempt from taxation only if certain criteria are met such as residing outside of the country for at least 330 days over a 12-month period, or an entire calendar year.

Tax Treaties

The United States has income tax treaties with a number of foreign countries, but these treaties generally don't exempt residents from their obligation to file a tax return.

Under these treaties, residents (not necessarily citizens) of foreign countries are taxed at a reduced rate or are exempt from U.S. income taxes on certain items of income they receive from sources within the United States. These reduced rates and exemptions vary among countries and specific items of income.

Treaty provisions are generally reciprocal; that is they apply to both treaty countries. Therefore, a U.S. citizen or resident who receives income from a treaty country and who is subject to taxes imposed by foreign countries may be entitled to certain credits, deductions, exemptions, and reductions in the rate of taxes of those foreign countries.

Affordable Care Act

Starting in 2014, the individual shared responsibility provision calls for each individual to have minimum essential coverage for each month, qualify for an exemption, or make a payment when filing his or her federal income tax return. All U.S. citizens are subject to the individual shared responsibility provision. If you are not yet eligible for Medicare, U.S. citizens living abroad are generally subject to the same individual shared responsibility provision as U.S. citizens living in the United States.

Caution: You may have heard that under tax reform the penalty for the individual mandate has been eliminated. While this is true, it does not take effect until January 1, 2019.

U.S. citizens or residents living abroad for at least 330 days within a 12-month period are treated as having minimum essential coverage during those 12 months and thus will not owe a shared responsibility payment for any of those 12 months. Also, U.S. citizens who qualify as a bona fide resident of a foreign country for an entire taxable year are treated as having minimum essential coverage for that year.

State Taxes

Many states tax resident income as well, so even if you retire abroad, you may still owe state taxes--unless you established residency in a no-tax state before you moved overseas.

Some states honor the provisions of U.S. tax treaties; however, some states do not. Therefore it is prudent to consult a tax professional.

Relinquishing U.S. Citizenship

Taxpayers who relinquish their U.S. citizenship or cease to be lawful permanent residents of the United States during any tax year must file a dual-status alien return and attach Form 8854, Initial and Annual Expatriation Statement. A copy of the Form 8854 must also be filed with Internal Revenue Service (Philadelphia, PA 19255-0049), by the due date of the tax return (including extensions).

Note: Giving up your U.S. citizenship doesn't mean giving up your right to receive social security, pensions, annuities or other retirement income. However, the U.S. Internal Revenue Code (IRC) requires the Social Security Administration (SSA) to withhold nonresident alien tax from certain Social Security monthly benefits. If you are a nonresident alien receiving social security retirement income, then SSA will withhold a 30 percent flat tax from 85 percent of those benefits unless you qualify for a tax treaty benefit. This results in a withholding of 25.5 percent of your monthly benefit amount.

Consult a Tax Professional Before You Retire

Don't wait until you're ready to retire to consult a tax professional. Call the office today and find out what your options are well in advance of your planned retirement date.

The Home Office Deduction: What's New

Self-employed taxpayers who use their home for business may be able to deduct expenses for the business use of it. Qualified persons can claim the deduction whether they rent or own their home and can use the simplified option or the regular method to claim a deduction.

For tax years prior to 2018, employees could also claim home office expenses as deductions provided they met additional rules such as business use must also be for the convenience of the employer (not just the employee). Tax reform legislation passed in 2017 however, repealed certain itemized deductions on Schedule A, Itemized Deductions for tax years 2018 through 2025, including employee business expense deductions related to home office use, affecting many remote employees.

As a reminder, here are five tips to keep in mind about the home office deduction:

1. Regular and Exclusive Use. Generally, taxpayers must use a part of their home regularly and exclusively for business purposes. The part of a home used for business must also be:

- A principal place of business, or

- A place where taxpayers meet clients or customers in the normal course of business, or

- A separate structure not attached to the home. Examples could include a garage or a studio.

2. Simplified Option. To use the simplified option, multiply the allowable square footage of the office by a rate of $5. The maximum footage allowed is 300 square feet. This option will save time because it simplifies how to figure and claim the deduction. It will also make it easier to keep records. The rules for claiming a home office deduction remain the same.

3. Regular Method. This method includes certain costs paid for a home. For example, part of the rent for rented homes may qualify. For homeowners, part of the mortgage interest, taxes and utilities paid may qualify. The amount deducted usually depends on the percentage of the home used for business.

4. Deduction Limit. If the gross income from the business use of a home is less than expenses, the deduction for some expenses may be limited.

5. Self-Employed. Taxpayers who are self-employed and choose the regular method should use Form 8829, Expenses for Business Use of Your Home, to figure the amount to deduct. Claim the deduction using either method on Schedule C, Profit or Loss from Business.

Please call if you would like more information about the home office deduction.

Small Business Payroll Expenses

Federal law requires most employers to withhold federal taxes from their employees' wages. Whether you're a small business owner who's just starting out or one who has been in business a while and is ready to hire an employee or two, here are five things you should know about withholding, reporting, and paying employment taxes.

1. Federal Income Tax. Small businesses first need to figure out how much tax to withhold. Small business employers can better understand the process by starting with an employee's Form W-4 and the withholding tables described in Publication 15, Employer's Tax Guide. Please call if you need help understanding withholding tables.

2. Social Security and Medicare Taxes. Most employers also withhold social security and Medicare taxes from employees' wages and deposit them along with the employers' matching share. In 2013, employers became responsible for withholding the Additional Medicare Tax on wages that exceed a threshold amount as well. There is no employer match for the Additional Medicare Tax, and certain types of wages and compensation are not subject to withholding.

3. Federal Unemployment (FUTA) Tax. Employers report and pay FUTA tax separately from other taxes. Employees do not pay this tax or have it withheld from their pay. Businesses pay FUTA taxes from their own funds.

4. Depositing Employment Taxes. Generally, employers pay employment taxes by making federal tax deposits through the Electronic Federal Tax Payment System (EFTPS). The amount of taxes withheld during a prior one-year period determines when to make the deposits. Publication 3151-A, The ABCs of FTDs: Resource Guide for Understanding Federal Tax Deposits and the IRS Tax Calendar for Businesses and Self-Employed are helpful tools.

Failure to make a timely deposit can mean being subject to a failure-to-deposit penalty of up to 15 percent. But the penalty can be waived if an employer has a history of filing required returns and making tax payments on time. Penalty relief is available, however. Please call the office for more information.

5. Reporting Employment Taxes. Generally, employers report wages and compensation paid to an employee by filing the required forms with the IRS. E-filing Forms 940, 941, 943, 944 and 945 is an easy, secure and accurate way to file employment tax forms. Employers filing quarterly tax returns with an estimated total of $1,000 or less for the calendar year may now request to file Form 944,Employer's ANNUAL Federal Tax Return once a year instead. At the end of the year, the employer must provide employees with Form W-2, Wage and Tax Statement, to report wages, tips, and other compensation. Small businesses file Forms W-2 and Form W-3, Transmittal of Wage and Tax Statements, with the Social Security Administration and if required, state or local tax departments.

Questions about payroll taxes?

If you have any questions about payroll taxes, please contact the office.

Tip Income: Is it Taxable?

The short answer is that yes, tips are taxable. If you work at a hair salon, barber shop, casino, golf course, hotel, or restaurant, or drive a taxicab, then the tip income you receive as an employee from those services is considered taxable income. Here are a few other tips about tips:

-

Taxable income. Tips are subject to federal income and Social Security and Medicare taxes, and they may be subject to state income tax as well. The value of noncash tips, such as tickets, passes, or other items of value, is also income and subject to federal income tax.

-

Include tips on your tax return. In your gross income, you must include all cash tips you receive directly from customers, tips added to credit cards, and your share of any tips you receive under a tip-splitting arrangement with fellow employees.

-

Report tips to your employer. If you receive $20 or more in tips in any one month, you should report all your tips to your employer. Your employer is required to withhold federal income, Social Security, and Medicare taxes.

-

Keep a daily log of your tip income. Be sure to keep track of your tip income throughout the year. If you'd like a copy of the IRS form that helps you record it, please call.

Tips can be tricky. Don't hesitate to contact the office if you have questions.

IRS Debuts New Tax Exempt Organization Search Tool

As hurricane season gets underway--and with it, the possibility of scam groups masquerading as charitable organizations--taxpayers should know about the new tax-exempt organization search tool. Located on the IRS website, the Tax Exempt Organization Search (TEOS) tool replaces the EO Select Check tool and enables taxpayers to search and access information about tax-exempt organizations quickly. TEOS is mobile friendly as well, accessible on tablets or smartphones.

When you use the new TEOS tool you will be able to:

- Access images of an organization's forms 990, 990-EZ, 990-PF, and 990-T filed with the IRS. Initially, only 990 series forms filed in January and February 2018 will be available. New filings will be added monthly.

- Find out additional information about exempt organizations than was previously available using EO Select Check.

- Conduct a simplified search process.

- Access favorable determination letters issued by the IRS when an organization applied for and met the requirements for tax-exempt status. At first, a limited number of determination letters will be available. Determination letters issued since January 2014 will also be available in the future.

Taxpayers can use TEOS to find information previously available on EO Select Check including whether an organization:

- Is eligible to receive tax-deductible contributions.

- Has had its tax-exempt status revoked because it failed to file required forms or notices for three consecutive years.

- Filed a Form 990-N annual electronic notice with the IRS; this applies to small organizations only.

Publicly available data from electronically-filed 990 forms are still available through Amazon Web Services. Please call or visit the IRS website for additional details. If you have any other questions about the new TEOS tool, don't hesitate to contact the office.

Penalty Relief for Transition Tax on Foreign Earnings

Section 965 of the Internal Revenue Code, enacted in December 2017, imposes a transition tax on untaxed foreign earnings of foreign corporations owned by U.S. shareholders by deeming those earnings to be repatriated. Foreign earnings held in the form of cash and cash equivalents are taxed at a 15.5 percent rate, and the remaining earnings are taxed at an 8 percent rate. The transition tax generally may be paid in installments over an eight-year period when a taxpayer files a timely election under section 965(h).

Late-payment and filing penalty relief is now available for taxpayers affected by the section 965 transition tax, in accordance with the following guidance:

- In some instances, the IRS will waive the estimated tax penalty for taxpayers subject to the transition tax who improperly attempted to apply a 2017 calculated overpayment to their 2018 estimated tax, as long as they make all required estimated tax payments by June 15, 2018.

- For individual taxpayers who missed the April 18, 2018, deadline for making the first of the eight annual installment payments, the IRS will waive the late-payment penalty if the installment is paid in full by April 15, 2019. Absent this relief, a taxpayer's remaining installments over the eight-year period would have become due immediately. This relief is only available if the individual's total transition tax liability is less than $1 million. Interest will still be due. Later deadlines apply to certain individuals who live and work outside the U.S.

- Individuals who have already filed a 2017 return without electing to pay the transition tax in eight annual installments can still make the election by filing a 2017 Form 1040X, Amended U.S. Individual Income Tax Return with the IRS. The amended Form 1040 generally must be filed by October 15, 2018.

If you have any questions or need more information about the transition tax and other tax reform provisions, don't hesitate to call.

All about Sales Receipts in QuickBooks

You know how important it is to obtain receipts for the expenses you and your employees incur. You need to record them, analyze their impact on your cash flow, and claim some of them on your income taxes.

Your customers, too, expect to receive forms documenting purchases they've made from you. When they pay you immediately for goods or services, you'll give them a sales receipt, rather than invoicing them for future remittance. Not only will your customers have a record of the transaction--you will, too.

QuickBooks supports the creation and tracking of sales receipts. It manages the mechanics of this important task incredibly well and eliminates the need to enter receipt data twice, once on a paper copy for your customer and again in your accounting system. This QuickBooks feature not only minimizes errors but saves time and lessens the possibility of disputes down the road.

A Simple Form

Here's an example of a situation that illustrates the importance of really learning about and understanding QuickBooks before you start entering live data. Say you got a check from a customer on the spot for a house painting job you completed. When you look at QuickBooks' home page, which icon do you click?

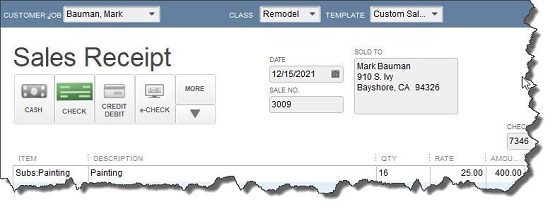

You might be tempted to click Receive Payments since that's exactly what you are doing. But that screen is reserved for revenue that comes in to satisfy outstanding invoices and unpaid items on billing statements. Instead, you would click Create Sales Receipts to open the Enter Sales Receipts window. Here's a partial view of what you would see:

Figure 1: When a customer pays you immediately for goods or services, you need to open and complete the Enter Sales Receipts window.

If you've already entered your customer and item/service records in QuickBooks, you can record your sale very quickly here. Even if you haven't, or if you need to create a new record on the fly, you can select

Warning: Do you need to track inventory levels for products you sell? Have you created accurate records for these items? There is information that QuickBooks needs to help ensure that you don't run out of stock or keep too much on hand. Let a QuickBooks professional walk you through the software's inventory-management tools so you can take advantage of all the benefits it offers.

Once you've selected the appropriate customer, Class (if you use this feature), and Template (Here again, do you understand that you can either use the default sales receipt form provided by QuickBooks or customize it? We can help here), make sure that the Date and Sale No. are correct.

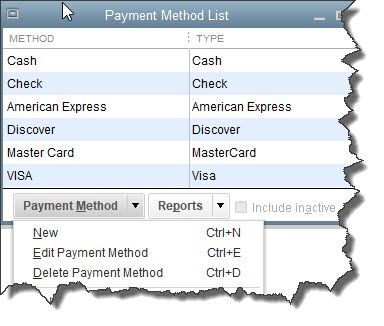

Next, click on the icon representing the transaction's payment method, choosing from Cash, Check, Credit Card, or eCheck. Click the More button if your method isn't listed there. Here, you can add new options by selecting Add New Payment Method. A small window will open allowing this. If you want to modify this list further by editing and deleting the default methods for example, simply clear and close the current sales receipt, and then open the Lists menu, and select Customer & Vendor Profile Lists | Payment Method List. This window will open:

Figure 2: Click the down arrow in the Payment Method field near the bottom of this window to see your modification options.

Once you have chosen the desired Payment Method (and entered a check number if necessary), complete the rest of the sales receipt much like you would an invoice, by selecting the correct products or services, the quantity you are selling, and the transaction's tax status. QuickBooks will fill in the rest if you 've created complete item records.

When you are done save the sales receipt. Information about the transaction will be available in standard places like the Customer Information screens and various reports.

Whether your revenue is generated instantly (i.e., documented by a sales receipt) or as longer-term payment on an invoice, your company's income is just one element of the cash flow equation. Are you able to create and interpret the reports that can help you understand these complex calculations, like Cash Flow Forecast and Profit & Loss? You probably run some of QuickBooks' more basic sales reports regularly, but consider bringing in a QuickBooks expert to do the deep analysis needed to make better business decisions.

Tax Due Dates for July 2018

July 10

Employees Who Work for Tips - If you received $20 or more in tips during June, report them to your employer. You can use Form 4070.

July 16

Employers - Nonpayroll withholding. If the monthly deposit rule applies, deposit the tax for payments in June.

Employers - Social Security, Medicare, and withheld income tax. If the monthly deposit rule applies, deposit the tax for payments in June.

July 31

Employers - Social Security, Medicare, and withheld income tax. File Form 941 for the second quarter of 2018. Deposit any undeposited tax. (If your tax liability is less than $2,500, you can pay it in full with a timely filed return.) If you deposited the tax for the quarter in full and on time, you have until August 10 to file the return.

Employers - Federal unemployment tax. Deposit the tax owed through June if more than $500.

Employers - If you maintain an employee benefit plan, such as a pension, profit-sharing, or stock bonus plan, file Form 5500 or 5500-EZ for calendar-year 2017. If you use a fiscal year as your plan year, file the form by the last day of the seventh month after the plan year ends.

Certain Small Employers - Deposit any undeposited tax if your tax liability is $2,500 or more for 2018 but less than $2,500 for the second quarter.

Do you have any questions? Contact Paramount Tax today, we're happy to help!